Medical Tourism In Thailand

Market Overview

The Thailand medical tourism market size was valued at USD 2.9 billion in 2023 and is projected to grow at a CAGR of 42.9% from 2024 to 2030, reaching approximately USD 16.0 billion by the end of the forecast period. Key growth drivers include affordable treatment costs, cutting-edge medical technology, skilled medical professionals, and Thailand’s strong reputation for hospitality and tourism infrastructure.

Key Trends in 2024

Rise in Demand for Specialized Treatments

Uninsured procedures such as gender reassignment surgeries, fertility treatments, dental reconstructions, and cosmetic surgeries are witnessing rapid growth due to Thailand’s affordability and expertise.Advanced Healthcare Infrastructure

Thailand offers world-class hospitals with international accreditations (JCI-certified), including:- Bumrungrad International Hospital

- Bangkok Hospital

- Samitivej Sukhumvit Hospital

Government Initiatives

- Thailand introduced USD 14,000 medical coverage for tourists in 2024 to reassure safety and enhance medical tourism.

- Visa exemptions for countries like India have increased patient inflow.

Why Medical Tourism in Thailand?

1. Cost-Effectiveness

Treatments in Thailand cost 30-70% less than in the U.S. and Europe. Example: Coronary Angioplasty costs USD 55,000–57,000 in the U.S. but only USD 4,500–10,600 in Thailand.

2. High-Quality Medical Care

Internationally accredited hospitals with advanced technologies (e.g., robotic surgery, advanced cancer care). Highly skilled surgeons trained globally.

3. Tourism Infrastructure

Thailand ranks among the top 5 global destinations for medical tourism, supported by excellent connectivity (international airports, direct flights) and world-renowned hospitality..

4. Expertise in Specialized Fields

Thailand excels in key medical fields: Oncology: Advanced cancer treatments at a fraction of Western costs. Neurosurgery: Fastest-growing segment due to cutting-edge technologies and expert neurosurgeons. Plastic & Cosmetic Surgery: Leading destination for facial aesthetics, breast implants, liposuction, and more.

5. Reputation as a Tourist Hub

Thailand's natural beauty, luxury accommodations, and cultural attractions encourage patients to combine medical treatment with tourism.

Market Concentration & Competitive Landscape

The market is accelerating with key players investing in infrastructure, partnerships, and M&A activities. Notable players include:

- Bumrungrad International Hospital

- Bangkok Dusit Medical Services (BDMS)

- Samitivej Sukhumvit Hospital

- Phyathai Hospitals

- Kasemrad International Hospital

Recent Developments

- March 2024: Vejthani Hospital launched an information center in Bangladesh to expand its reach.

- January 2024: BDMS partnered with CNN International to advance healthcare technology and outreach.

November 2023: PlacidWay partnered with Vega Stem Cell Clinic to enhance regenerative medicine.

Market Segmentation

| Treatment Type | Revenue (USD Million), 2023 | CAGR (2024–2030) |

|---|---|---|

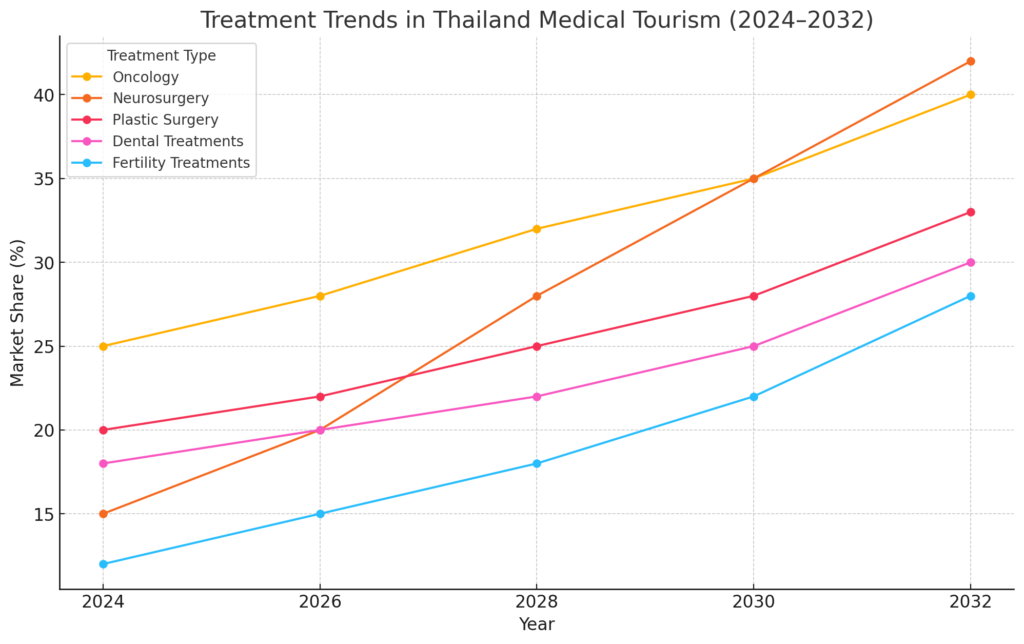

| Oncology | 25% Share | 35% |

| Neurosurgery & Spine Surgery | Fastest-Growing | 45% |

| Plastic & Reconstructive Surgery | High Demand | 40% |

| Dentistry | Increasing Adoption | 38% |

| Gynecology, ENT, Urology, Others | Steady Growth | 30–35%

|

Opportunities for Investors

- Strategic Partnerships: Collaborate with Thai hospitals to attract international patients.

- Technology Integration: Invest in telemedicine, AI diagnostics, and healthcare innovations.

- Regenerative Medicine: High growth in stem cell therapy and advanced treatments.

- Wellness Tourism: Expand into combined medical-wellness packages.

Market Trends and Insights

1. Increasing Demand for Specialized Procedures

Thailand is witnessing rapid growth in medical fields such as:

- Oncology: With a 25% market share in 2023, Thailand offers affordable, high-quality cancer care through advanced therapies and skilled professionals.

- Neurosurgery: Expected to grow at the fastest CAGR due to cutting-edge technologies and highly trained neurosurgeons specializing in complex brain and spine surgeries.

- Plastic & Reconstructive Surgery: Thailand remains a global leader in procedures like facelifts, breast augmentation, and liposuction, drawing patients seeking affordability and expertise.

2. Strategic Partnerships and International Collaborations

Hospitals in Thailand are increasingly forming partnerships with international healthcare providers to improve their services and attract more global patients.

- Example: Bangkok Dusit Medical Services (BDMS) partnered with CNN International Commercial (CNNIC) in January 2024 to advance medical technology and awareness.

3. Government Initiatives and Market Expansion

- Recent visa relaxations and medical coverage policies have enhanced Thailand’s appeal to international patients.

The government continues to invest in infrastructure, such as upgrading hospitals and streamlining medical travel processes.

4. Growing Focus on Wellness and Regenerative Medicine

Thailand is at the forefront of regenerative treatments such as stem cell therapy, which is revolutionizing patient care and creating new opportunities in the medical tourism market.

Conclusion

Thailand’s medical tourism market is thriving due to its strategic mix of cost efficiency, medical excellence, and robust government support. With projected annual growth of 42.9%, the country is poised to become the global leader in medical tourism, offering unparalleled opportunities for investors and healthcare stakeholders.

Hospitals equipped with over 171,000 beds,

60 JCI accredited hospitals

CAGR from 2024–2030

Healthcare Investment:

Future Vision: The Next Decade of Thailand’s Medical Tourism

1. Smart Healthcare Ecosystems

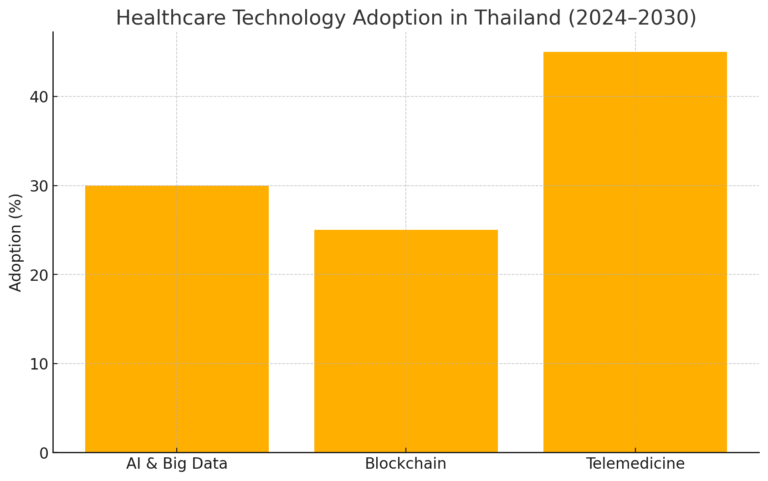

Thailand is revolutionizing healthcare delivery by transitioning into smart healthcare hubs, integrating cutting-edge technologies:

- AI and Big Data: Enhancing precision medicine, reducing diagnosis time, and improving patient care.

- Blockchain: Ensuring secure sharing of medical records across hospitals and global stakeholders.

- Telemedicine Platforms: Providing seamless pre- and post-operative care for international patients, reducing travel requirements.

:

2. Expansion into Wellness Tourism

The Thai government is blending medical treatments with holistic health experiences to position Thailand as a global wellness hub:

- Development of luxury recovery centers combining post-surgical care with spa and wellness therapies.

- Launch of anti-aging, weight loss, and stress management programs to attract long-stay international patients.

Metric Insight:

The wellness tourism market in Thailand is projected to contribute over USD 2.5 billion annually by 2030.

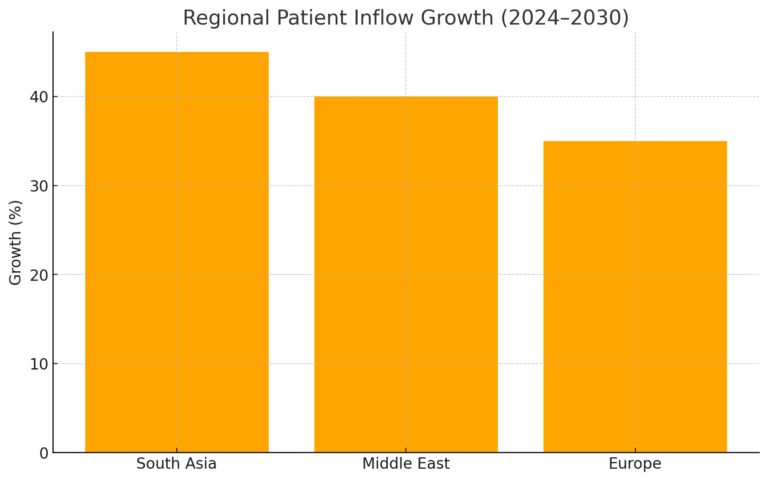

3-Increased Regional Market Penetration

Thailand is strategically positioning itself as the leading healthcare destination for patients in:

- South Asia: Increasing partnerships with Indian healthcare providers.

- Middle East: Rising influx for fertility treatments, cosmetic surgery, and dental care.

- Europe: Targeting patients seeking orthopedic surgeries, neurosurgery, and oncology treatments at affordable costs.

4. Government Policy Enhancements

The Thai government is driving growth through supportive policies:

- Tax Incentives: Attracting foreign investments in healthcare infrastructure and technology.

- Medical Visa Expansion: Increasing visa validity to accommodate long-term treatments.

- Dedicated Medical Zones: Establishing multilingual hubs with international-level facilities for foreign patients.

Metric Insight:

- Thailand’s visa exemption policies contributed to a 25% increase in patient arrivals from India and neighboring regions in 2023.

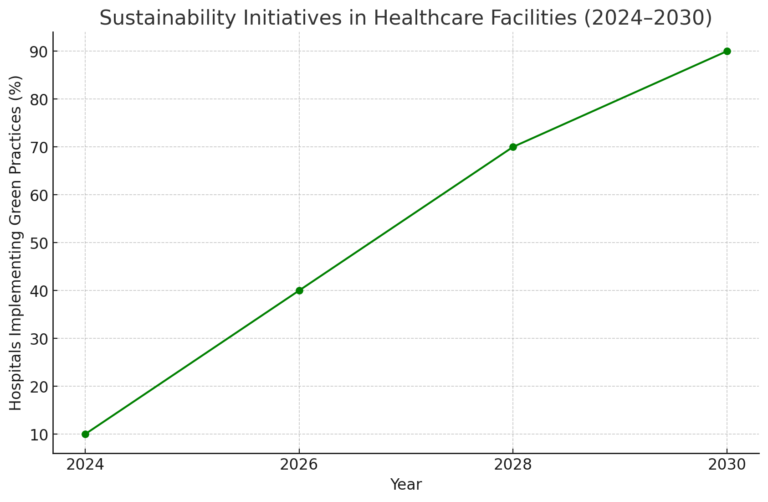

5. Sustainability in Healthcare Tourism

Thailand is ensuring long-term growth through eco-friendly and sustainable practices:

- Hospitals adopting green infrastructure and efficient waste management systems.

- Wellness programs integrating environmental sustainability and eco-conscious therapies.

Investment Opportunities

| Opportunity | Description | Potential ROI |

|---|---|---|

| Technology Integration | Investment in AI, robotics, and telemedicine for hospital modernization. | High (Projected CAGR: 35%) |

| Wellness Tourism | Development of luxury recovery centers and anti-aging wellness programs. | High (USD 2.5B by 2030) |

| Infrastructure Development | Expanding airports, medical hubs, and sustainable healthcare zones. | Moderate to High ROI |

| Strategic Partnerships | Collaborations with global hospitals for knowledge exchange and patient inflow. | High (40–50% market share growth) |

With an anticipated CAGR of 42.9% and revenue projected to reach USD 16.0 billion by 2030, Thailand is on the path to becoming the global leader in medical and wellness tourism. For investors, Thailand offers a future-ready healthcare ecosystem with significant ROI potential, promising a sustainable and innovative decade ahead.

Summary of the Report: Medical Tourism in Thailand

Healthcare Excellence

Thailand has positioned itself as a global hub for medical tourism, offering world-class healthcare services at affordable costs. The country is home to JCI-accredited hospitals and internationally trained medical professionals, providing exceptional patient care in various specialized fields:

- Oncology: High-quality cancer treatments with advanced therapies and precision medicine.

- Neurosurgery: Cutting-edge brain and spine surgeries using state-of-the-art technologies.

- Plastic Surgery: Thailand is a global leader in cosmetic procedures such as breast augmentation, facelifts, and gender reassignment surgeries.

- Dental Care: Comprehensive dental reconstruction services at a fraction of global costs.

Key Fact: Thailand’s hospitals, including Bumrungrad International Hospital and Bangkok Hospital, are globally recognized for their medical expertise and technology.

Advanced Technological Leadership

Thailand’s healthcare sector integrates cutting-edge technologies to deliver smart healthcare solutions:

- AI-Powered Diagnostics: Improving accuracy in patient care and accelerating diagnosis.

- Robotic-Assisted Surgeries: Minimally invasive procedures ensuring precision, reduced recovery time, and better outcomes.

- Telemedicine Platforms: Enabling international patients to access consultations and follow-up care virtually, reducing travel burdens.

Impact: These innovations position Thailand as a leading destination for patients seeking advanced treatments.

Cost-Effective Treatments with High Quality

Thailand offers significant cost savings compared to Western countries, without compromising quality:

- Example:

- Coronary Angioplasty: USD 4,500–10,600 in Thailand vs. USD 55,000–57,000 in the U.S.

- Dental Implants: USD 1,000–2,000 compared to USD 5,000–6,000 globally.

Insight: Patients save up to 70% on medical costs while benefiting from internationally accredited care.

Luxury Medical Experiences

Thailand seamlessly combines medical treatments with luxury wellness tourism:

- Luxury Recovery Centers: Combining post-surgical recovery with spa treatments, holistic therapies, and scenic accommodations.

- Personalized Concierge Services: Travel planning, multilingual support, and premium care packages for international patients.

- Wellness Programs: Anti-aging therapies, stress management, and weight loss programs tailored to patient needs.

Highlight: Thailand’s unique “Treatment + Tourism” model ensures a seamless and holistic medical journey.

Strategic Growth and Market Leadership

The Thai government actively supports the medical tourism sector through favorable policies:

- Visa Exemptions: Simplified entry processes for patients from key regions like South Asia and the Middle East.

- Medical Zones: Development of multilingual, international patient hubs with dedicated facilities.

- Insurance Initiatives: Introduction of USD 14,000 medical coverage for international patients to enhance confidence and safety.

Key Metrics:

- Thailand ranked 5th globally in medical tourism (2023).

- International patients contribute over 11.9 billion Baht annually.

Investment Opportunities

- Smart Healthcare: Investment in AI, robotics, and telemedicine for healthcare modernization.

- Luxury Wellness Tourism: Development of high-end recovery centers and holistic wellness programs.

- Infrastructure Expansion: Investments in international airports, medical zones, and digital patient platforms.

- Strategic Partnerships: Collaborations with hospitals to enhance patient outreach and global competitiveness.

Future-Proof Growth and Outlook

Thailand’s medical tourism market is on a robust growth trajectory, driven by technology, wellness integration, and strategic government policies:

Market Insights:

- Market Size in 2023: USD 2.9 billion

- Projected Market Value by 2030: USD 16.0 billion

- Growth Rate (CAGR 2024–2030): 42.9%

Top Treatments in Demand:

- Oncology: 25% share in 2023.

- Plastic Surgery: Rising demand for cosmetic and reconstructive procedures.

- Neurosurgery: Fastest-growing segment with 45% CAGR.

- Dental Treatments: High patient inflow from Europe and the Middle East.

Global Appeal and Patient-Centric Care

Thailand prioritizes international patients by offering:

- Dedicated International Patient Services: End-to-end assistance with travel, treatment, and recovery.

- Multilingual Support: Staff proficient in English, Arabic, Mandarin, and other key languages.

- Cultural Inclusivity: Dietary accommodations, religious sensitivities, and family support services.

- Telehealth Services: Pre- and post-treatment virtual consultations for global accessibility.

Future Vision

Thailand is poised to become the global leader in medical and wellness tourism, driven by:

- Technological Innovation: AI diagnostics, robotic surgeries, and regenerative medicine.

- Sustainability: Green hospitals and eco-friendly wellness programs.

- Strategic Growth: Government-backed infrastructure and luxury medical experiences.

Projection: By 2030, Thailand’s medical tourism revenues are set to reach USD 16.0 billion, cementing its position as a top international medical destination.

Thailand Market

2024 Statistics

- Market Size: USD 2.9 billion (2023)

- Projected Revenue: USD 16.0 billion by 2030

- Growth Rate (CAGR): 42.9% (2024–2030)

- Global Ranking: 5th in medical tourism worldwide

- Top Treatments: 25% Oncology 20% Plastic Surgery 15% Neurosurgery

Download The Full Report

Other Countries Reports

Check Our Latest Medical Tourism Trending Report by countries :

FAQ

The Thailand medical tourism market was valued at USD 2.9 billion in 2023 and is projected to grow at a CAGR of 42.9% from 2024 to 2030, reaching approximately USD 16.0 billion by 2030. This rapid growth highlights Thailand’s strong position as a global leader in affordable and high-quality medical treatments.

Key drivers of Thailand’s medical tourism growth include:

- Affordable Healthcare: Treatments cost 30–70% less compared to the U.S. and Europe.

- World-Class Hospitals: Thailand hosts JCI-accredited facilities like Bumrungrad International Hospital and Bangkok Hospital.

- Advanced Technologies: Integration of AI diagnostics, robotic surgeries, and telemedicine platforms.

- Government Support: Favorable visa policies, insurance coverage for international patients, and investment in infrastructure.

- Wellness Tourism: Luxury recovery centers and holistic wellness programs attract patients seeking a seamless treatment experience.

The thriving medical tourism market in Thailand offers promising investment opportunities, including:

Technology Integration:

- AI diagnostics, telemedicine platforms, and robotic-assisted surgeries to modernize healthcare delivery.

Luxury Recovery Centers:

- Development of high-end wellness centers combining medical recovery with spa, anti-aging, and wellness therapies.

Healthcare Infrastructure Development:

- Expanding international airports, medical hubs, and multilingual facilities for seamless patient journeys.

Strategic Partnerships:

- Collaborations with hospitals to enhance patient outreach in South Asia, the Middle East, and Europe.

Regenerative Medicine:

- Investments in stem cell therapies and cutting-edge treatments for chronic diseases and anti-aging solutions.

A Medical Tourism Funnel is a step-by-step framework that helps businesses attract, convert, and retain international patients:

Attraction Stage:

- Develop a strong digital presence with an SEO-optimized website, multilingual content, and targeted ad campaigns.

- Highlight Thailand’s competitive advantages, such as affordable care, JCI-accredited hospitals, and luxury wellness services.

Engagement Stage:

- Offer virtual consultations through telemedicine platforms to build trust and provide personalized treatment plans.

- Showcase patient testimonials, before-after case studies, and doctor interviews to enhance credibility.

Conversion Stage:

- Streamline the booking process with concierge services, visa support, and seamless payment options.

- Provide cost transparency, personalized packages, and multi-channel communication (WhatsApp, email, phone).

Retention Stage:

- Implement follow-up care through telemedicine and wellness support programs.

- Build long-term relationships through loyalty programs, referral incentives, and patient satisfaction surveys.

Impact: By leveraging a medical tourism funnel, businesses can effectively attract international patients, increase conversion rates, and scale operations to meet Thailand’s growing market demand.